Identify opportunities, underwrite risk, and structure acquisitions with comps and modeling to match target returns.

Miami Commercial Real Estate Advisory & Brokerage

Driving Investment Outcomes with Advanced Financial Analysis and Market Intelligence across South Florida.

Data-Driven Commercial Real Estate Solutions for Investors, Owners, and Operators.

Commercial Real Estate Services Built for Performance

Explore our core services across acquisitions, dispositions, leasing, and portfolio support, designed to move real estate decisions from strategy to execution.

Our Advisory Framework

From Data to Decision

We move beyond basic brokerage by applying institutional-grade rigor to every acquisition and disposition.

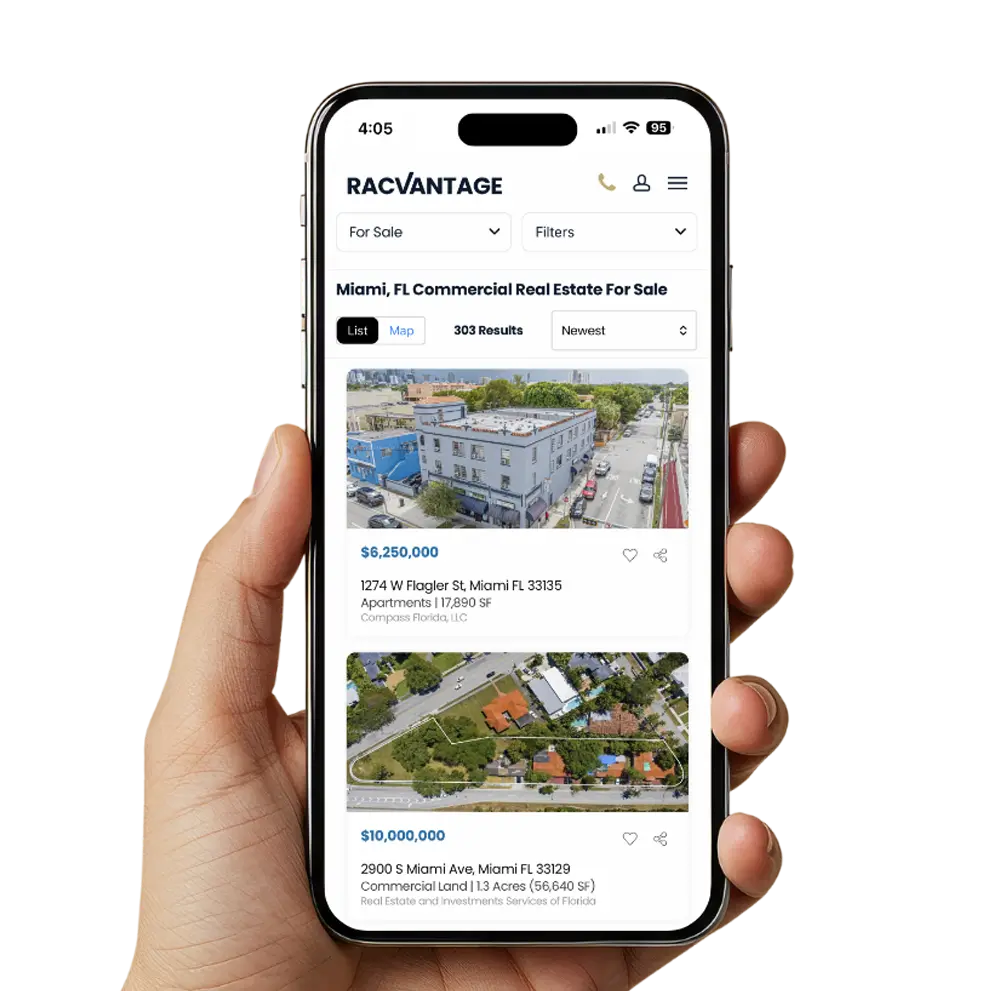

Featured Commercial Properties For Sale in Miami

Stay Ahead with Data-Driven Research

Market Insights

Frequently Asked Questions

How is RACVantage different from a traditional brokerage?

Traditional brokerages focus on listings and transactions. RACVantage focuses on underwriting, strategy, and execution designed to protect capital and maximize performance.

How does RACVantage evaluate investment opportunities?

We go beyond surface-level metrics. Our advisory uses institutional-grade financial modeling, including Internal Rate of Return (IRR), Net Operating Income (NOI) projections, and Cap Rate sensitivity analysis. This ensures our clients understand the risk-adjusted returns of any South Florida asset before committing capital.

Why is "Advisory and Capital" part of your name?

Our name reflects our three-pillared approach to the South Florida market:

- Real Estate: Deep local expertise in high-growth sectors, from data centers to industrial hubs.

- Advisory: A commitment to institutional-grade rigor, ensuring every decision is backed by exhaustive due diligence.

- Capital: A focus on your bottom line, using advanced financial modeling to optimize cash flows and investment yields.

Do you act as a broker or an advisor?

RACVantage operates as an advisory firm that also executes transactions. We provide direct representation, underwriting, negotiation, and execution aligned with investment and operational objectives.

Who typically works with RACVantage?

We work with investors, owners, and occupiers who require disciplined analysis, active representation, and outcome focused execution in commercial real estate decisions.

Let’s Talk Strategy—Not Just Transactions

If you are evaluating an investment, considering a sale, optimizing a portfolio, or planning your next move in Miami commercial real estate, RACVantage is your advisory partner.